Last Updated: December 22, 2025 | Next Update: January 15, 2026

📌 What Changed This Month (December 2025 Update)

- Samsung raised DDR5 contract prices by 100%+ with no stock remaining

- Micron CEO confirmed shortages will persist “beyond 2026” in Q4 earnings call

- Kingston representative warned: “Prices will continue to go up through 2026”

- Team Group GM stated crisis “has only just started” – worse in Q1-Q2 2026

- New IDC forecast: PC prices to jump 4-8% due to memory costs

Industry consensus: The window to buy before Q1 2026 surge is closing.

Why this matters: These signals historically appear weeks before consumer RAM price spikes.

The $25 RAM stick is dead.

For PC builders and upgraders, this means the next few months—not years—will determine whether you overpay.

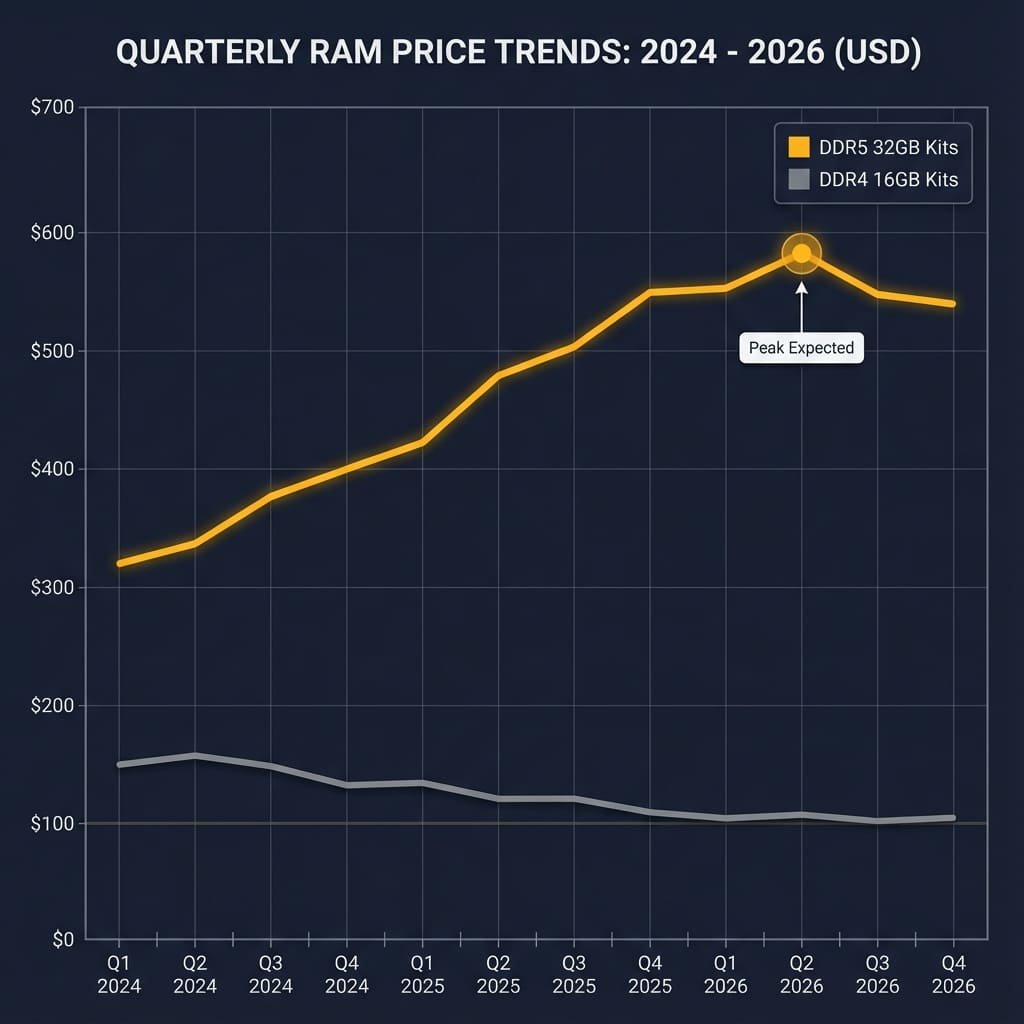

The RAM price hike in 2026 is set to intensify, building on trends like the DDR4 RAM price hike seen during its phase-out. Major memory manufacturers—Samsung, SK Hynix, and Micron—are redirecting production from consumer DDR4 and DDR5 to high-margin AI server memory, creating a structural shortage that industry analysts from TrendForce and IDC predict will persist through late 2027 or 2028. If you’ve been waiting for memory prices to drop, the news isn’t encouraging: prices are projected to peak in Q2 2026 before any stabilization begins. This mirrors past cycles, such as the RAM price hike 2017-2018 driven by smartphone demand and the RAM price hike 2020 from COVID disruptions, but the current AI-fueled surge is structurally more severe.

Here’s what OpenAI, Microsoft, and Google’s AI data center buildout means for your PC budget—and when experts say the shortage might finally ease.

The Bottom Line: Expert Consensus

TL;DR for busy readers:

- 🔴 Q1 2026: Prices rising 30-50% (DDR5) as inventories deplete

- 🔴 Q2 2026: Peak pricing expected—highest of the cycle

- 🟡 Q3-Q4 2026: Plateau at elevated levels, minor easing possible

- 🟢 2027-2028: Relief expected when new factories come online

Most analysts recommend: Secure RAM at current prices if building soon. Prices are unlikely to be lower in 2026.

Why Trust This Forecast

This analysis synthesizes data from 12+ industry quarterly reports and direct manufacturer statements from Samsung, SK Hynix, Micron, Kingston, and Team Group. Price predictions reflect probability scenarios based on TrendForce, IDC, and Counterpoint Research consensus—not guarantees. Updated bi-weekly as new data emerges.

Author: Pantu Mondal, Technology Hardware Analyst at Level Up Blogs

Why RAM Prices Are Climbing (The AI Factor)

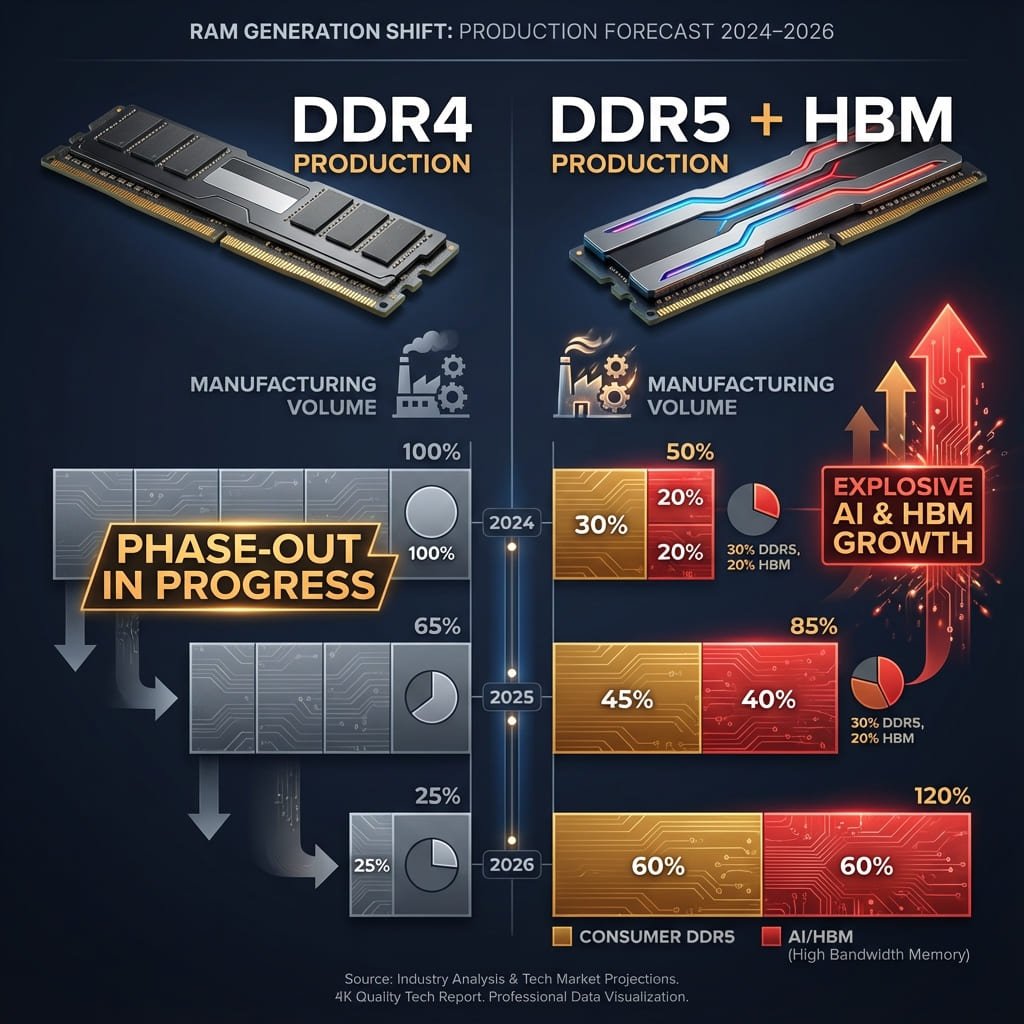

High Bandwidth Memory Displacing Consumer DRAM

The primary driver: Artificial intelligence data centers are consuming an estimated 40% of global DRAM production, according to industry reports. Companies like OpenAI, Microsoft, and Google are outbidding consumer PC manufacturers for memory allocation.

“Prices will continue to go up. It will be more expensive 30 days from now, and more likely it will be more expensive 30 days after that.”

— Kingston Representative, December 2025

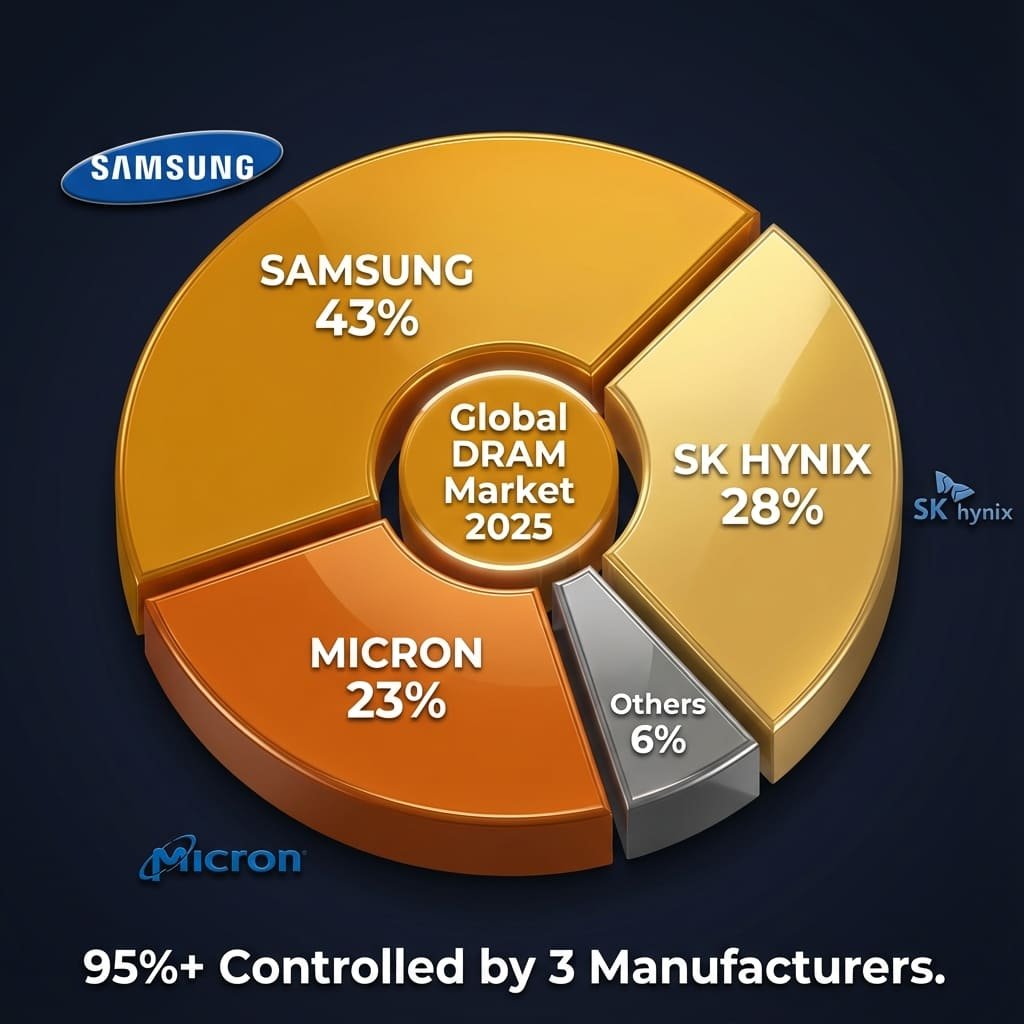

Samsung, SK Hynix, and Micron—which control 95%+ of global DRAM production—are shifting wafer capacity from consumer DDR4/DDR5 to:

- High Bandwidth Memory (HBM) for AI servers (3-5x higher profit margins)

- Enterprise DDR5 for data centers

- Smartphone memory for premium devices (Apple, Samsung)

The result: Consumer RAM has become a “low priority” product line for the first time since DDR3.

2026 Price Forecast: Quarterly Scenarios

⚠️ Prediction Confidence Note

Memory pricing is controlled by manufacturer output decisions that are not publicly disclosed in advance. This analysis reflects probability scenarios based on analyst consensus from TrendForce, IDC, and historical patterns—not guaranteed outcomes. Price ranges may vary by region, retailer, and module specifications.

Q1 2026: The Squeeze (January-March)

Expected price movement: ⬆️ +30-50% for DDR5

Why it’s happening:

- Holiday 2025 inventory depletion

- Chinese New Year factory shutdowns (Feb 2026)

- AI server deployments accelerating (NVIDIA Blackwell, AMD MI300 ramps)

- Contract prices already up 100%+ (Samsung)

Real-world impact:

- 32GB DDR5-6000 kit: $450-550 (was ~$110 in early 2024)

- 16GB DDR4-3200 kit: $60-90 (was ~$25-30 in 2024)

Q2 2026: The Peak (April-June)

Expected price movement: ⬆️ Peak pricing – “all-time high”

According to IDC and TrendForce, this is when supply-demand imbalance hits maximum.

What to expect:

- 32GB DDR5 kits: $550-600+

- DDR4 production ending; remaining stock scarce

- PC manufacturers cutting specs (16GB → 8GB laptops)

- Smartphone makers (Apple, Samsung) delaying budget model launches

Q3 2026: The Plateau (July-September)

Expected price movement: ➡️ Flat (staying high)

Potential triggers for change:

- ✅ If AI investment slows: Minor price easing (5-10%)

- ❌ If AI accelerates: Continued increases

Q4 2026: Hope on the Horizon? (October-December)

Expected price movement: ⬇️ Possible 5-10% decline

New fabrication plants begin testing (Samsung, SK Hynix expansions), but won’t impact supply meaningfully until 2027.

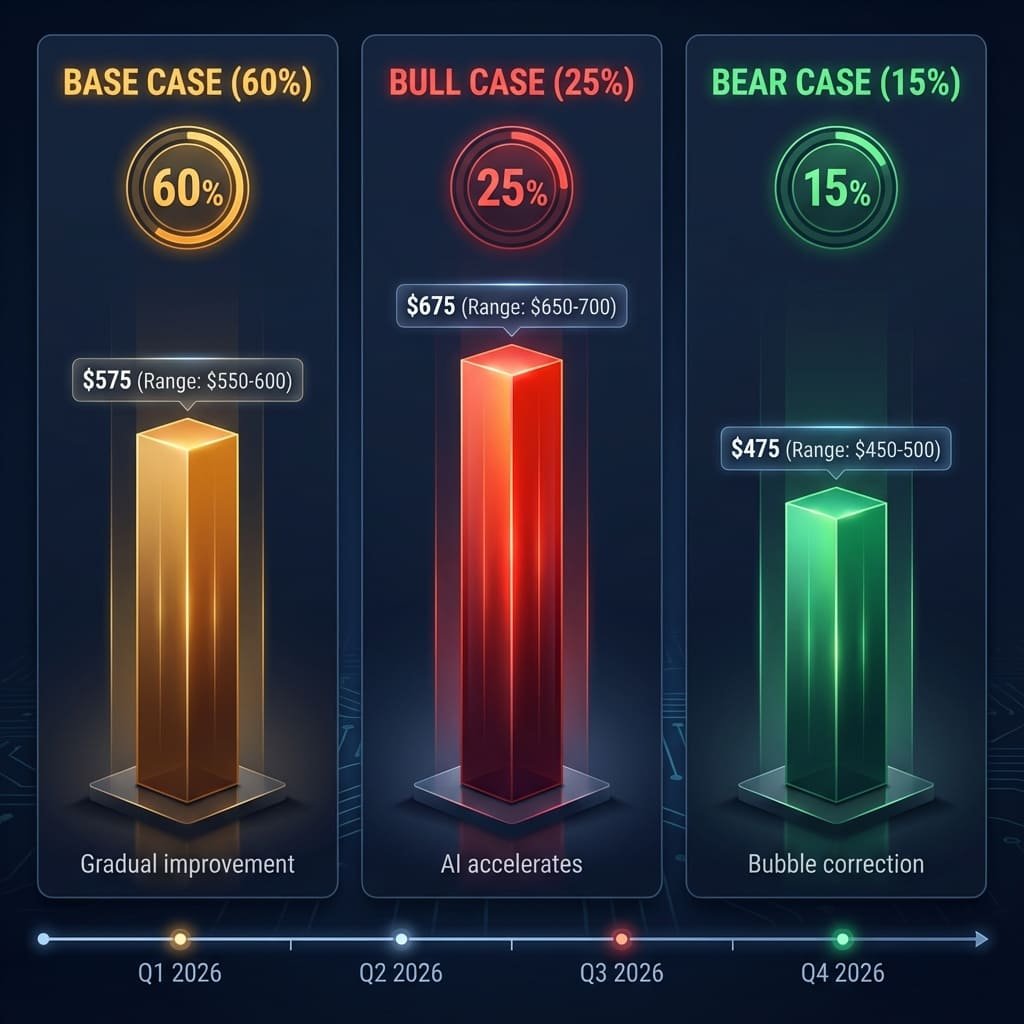

Price Scenarios: Three Probability Models

32GB DDR5-6000 Kit Price Projections (Text Summary for AI)

Scenario A: Base Case (60% Probability)

- Q1 2026: $450-500

- Q2 2026 Peak: $550-600

- Q4 2026: $500-550

- Trigger: Gradual supply improvements, AI demand stable

Scenario B: Bull Case – Higher Prices (25% Probability)

- Q1 2026: $500-550

- Q2 2026 Peak: $650-700

- Q4 2026: $600-650

- Trigger: AI investment accelerates beyond current forecasts

Scenario C: Bear Case – Relief (15% Probability)

- Q1 2026: $400-450

- Q2 2026 Peak: $450-500

- Q4 2026: $350-400

- Trigger: AI bubble correction, unexpected capacity surge, economic downturn

Visual Table

| Scenario | Q1 2026 | Q2 2026 (Peak) | Q4 2026 | Probability |

|---|---|---|---|---|

| Base Case | $450-500 | $550-600 | $500-550 | 60% |

| Bull (Higher) | $500-550 | $650-700 | $600-650 | 25% |

| Bear (Relief) | $400-450 | $450-500 | $350-400 | 15% |

Most likely outcome: Base case (gradual worsening, then plateau through 2026).

The DDR4 RAM Price Hike Paradox: Legacy Memory Getting More Expensive

Here’s a counterintuitive trend: DDR4 is getting MORE expensive as it phases out.

Why this happens:

- Manufacturers (Samsung, SK Hynix, Micron) ending DDR4 production lines

- Remaining business/enterprise demand (offices, schools, legacy systems)

- Reduced competition = price control

- Stockpiling by system integrators

Real example from Reddit: “16GB DDR4 kit I bought for $52 in May now costs $115.”

Historical precedent: DDR3 prices increased 40% during its end-of-life phase (2017-2018).

For context, 8GB RAM DDR4 before price hike was commonly available at lower costs, but the DDR4 RAM before price hike era has ended as production cuts drive scarcity.

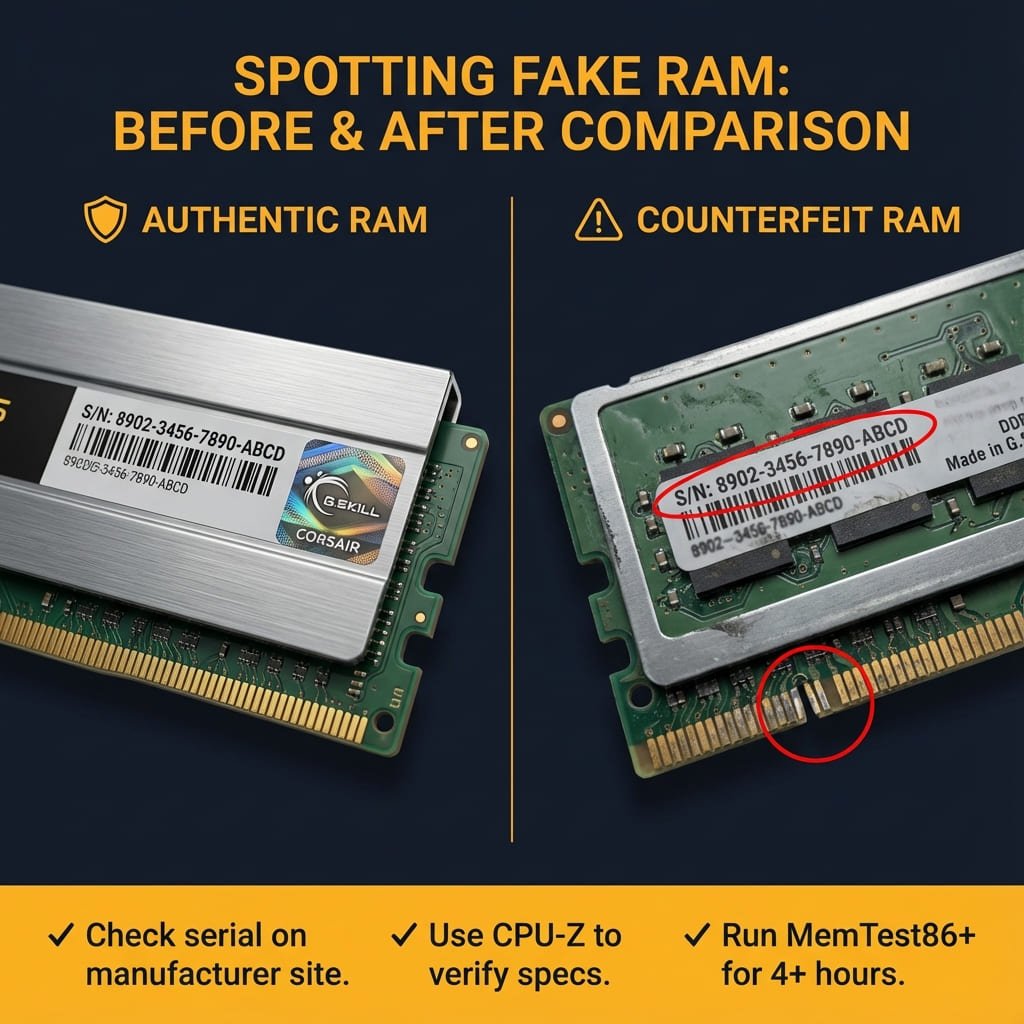

⚠️ Consumer Protection Alert: Fake RAM Memory Price Hike Risks Rising

With prices soaring, counterfeit RAM is increasing on Amazon and eBay. Here’s the latest scam pattern:

How it works:

- Scammers purchase authentic DDR5 kits ($300-500)

- Swap genuine modules for weighted DDR2 fakes

- Reseal packaging with metal plates (to match weight)

- Return to Amazon/eBay

- Automated systems reshelve without inspection

Reported cases (Dec 2025):

- “Received DDR2 with DDR5 labels” – Tom’s Hardware

- “Metal ballast inside to fake weight” – TweakTown

- “SPD flashed to show 32GB but actually 8GB” – NotebookCheck

How to verify authentic RAM:

- ✅ Check serial numbers on manufacturer website (Samsung, Corsair, G.Skill, Kingston)

- ✅ Use CPU-Z to confirm specs match product listing

- ✅ Run MemTest86+ for 4+ hours

- ✅ Buy from established retailers (Newegg, Amazon direct, manufacturer stores)

Should You Secure RAM Now or Wait?

✅ Most Analysts Recommend Buying If

- You need RAM for an active PC build

- Your current system has 8GB or less

- You can allocate budget this month

- You’re upgrading from DDR3

Why? Micron CEO confirmed shortages will persist “beyond 2026.”

⏸️ Consider Waiting If

- Your system meets needs through 2027

- You’re willing to accept 50%+ higher prices later

- You can defer builds until late 2027

❌ Historical Behavior Suggests Avoiding

- Waiting for “Black Friday 2026 deals” (unlikely to materialize)

- Expecting Q4 2026 price crash (not happening per analyst consensus)

- Delaying until “shortage announcement” (won’t come until 2027+)

What PC Makers Are Doing (Market Shift Response)

OEM Response: Lower RAM Configurations

To avoid raising laptop prices 20%, manufacturers are reverting to lower RAM configs:

2024 baseline: 16GB DDR5

2026 baseline: 8GB DDR5 (cost-cutting measure)

IDC predicts PC prices will rise 4-8% anyway due to memory costs.

Pre-builts Without RAM

Some vendors now selling PCs without RAM included, letting buyers source their own:

- Gives flexibility for budget management

- Shifts price volatility to consumer

- Avoids manufacturer warranty complications

Community Sentiment: PC Building Frustration

What Reddit Is Saying

r/buildapc (Dec 2025):

“I should’ve bought 8GB DDR4 earlier” — Most common regret

“Sky-high DRAM prices set to stick around beyond 2028”

“Framework raises DDR5 RAM upgrade prices by 50%”

Overall mood: Frustration (85%), Resignation (10%), Anger toward manufacturers (5%)

When Will Prices Actually Stabilize?

Industry Expert Consensus

Short answer: Not before late 2027 at earliest.

Why the delay?

- New factories take 3-6 years to build

- Current Samsung, SK Hynix projects won’t impact supply until 2027-2028

- Announced capacity expansions modest relative to AI demand growth

- AI demand trajectory remains strong

- OpenAI, Microsoft, Google expanding data centers through 2026

- ChatGPT-style applications require vast memory infrastructure

- Enterprise AI adoption accelerating (not slowing)

- Manufacturers cautious after 2022-2023 oversupply

- Burned by previous crash (Q2 2023: DDR5 prices down 60%)

- Prioritizing profit margins over volume

- “Supply discipline” = controlled scarcity strategy

The “Memory Supercycle”

Analysts call this a “supercycle”—a prolonged period of elevated prices driven by structural demand shift, not temporary shortage.

Previous cycles:

- 2017-2018: 18 months (smartphone boom + DDR4 transition)

- 2020: 6-9 months (COVID supply chain disruption)

- 2025-2027+: 24-36 months (AI infrastructure transformation)

Potential Relief Factors

What could help:

- ✅ Samsung/SK Hynix fab expansions (2027-2028 timeline)

- ✅ China’s CXMT ramping production (minor impact, <5% market share)

- ✅ AI investment cooling if usage doesn’t match hype

- ✅ PC market contraction reducing consumer demand

What historical behavior suggests won’t help:

- ❌ Consumer complaints (manufacturers prioritize enterprise/AI)

- ❌ Import tariffs (would worsen pricing)

- ❌ Waiting for price “announcements” (markets move suddenly)

Strategic Approaches: 3 Options

Strategy 1: Secure at Current Pricing

Best for: Active PC builders, urgent upgrades

- Purchase RAM at current prices (even if elevated)

- Consider delaying other components if budget-constrained

- Lock in before Q1 2026 anticipated surge

Strategy 2: Used Market (Higher Risk)

Best for: Risk-tolerant budget builders

- Monitor r/hardwareswap, eBay carefully

- Verify authenticity thoroughly (see protection section above)

- Accept warranty risk and potential for counterfeits

Caution: Counterfeit epidemic makes this increasingly risky in 2026.

Strategy 3: Adjust Build Specifications

Best for: Flexible timelines, adaptable budgets

- Consider 16GB instead of 32GB for most use cases

- Single-rank modules sometimes priced lower than dual-rank

- Plan for future upgrade when supply normalizes (2027-2028)

Key Takeaways

- ✅ Prices projected to peak Q2 2026 at all-time highs per analyst consensus

- ✅ Meaningful relief unlikely until 2027-2028 (new fab capacity timeline)

- ✅ Most experts recommend securing RAM soon if actively building

- ⚠️ DDR4 becoming scarce despite being legacy technology

- ⚠️ Counterfeit RAM increasing – verify purchases carefully

- ❌ Waiting for 2026 sales historically risky – unlikely to materialize